The process of establishing a secure user profile is paramount in today’s digital transactions. Ensuring proper user authentication is a foundational aspect of safeguarding sensitive information and enhancing the overall user experience. By implementing robust measures for validating users, platforms can fortify their defenses against potential threats.

Integrating secure transactions into the onboarding journey not only promotes confidence among users but also aligns with regulatory requirements. This alignment is essential for businesses aiming to maintain compliance and build trustworthy relationships with their clientele. A seamless sign-up experience can significantly contribute to this goal.

Moreover, the incorporation of KYC compliance plays a crucial role in the withdrawal process. It ensures that payment methods are secure and that users’ identities are thoroughly verified, thereby preventing fraudulent activities. By focusing on these aspects, platforms can guarantee a smoother experience for users while adhering to necessary regulations.

Through effective approaches to onboarding, businesses can achieve a balance between security and convenience, ultimately creating an environment where users feel safe throughout their engagement with the platform.

Step-by-Step Guide to Secure User Onboarding

When aiming for a smooth and safe user onboarding experience, it’s vital to prioritize user authentication. A thorough sign-up process should include multi-factor authentication to safeguard personal data security, ensuring that only authorized individuals gain access to their profiles.

During this phase, users must provide personal details for verification; therefore, clear communication regarding how these details will be utilized is essential. This transparency builds trust, allowing users to feel at ease while entering information.

It’s important to consider various payment methods that are available for funding accounts. Offering diverse options enhances user experience while complying with regulatory requirements. Users should be informed about secure transactions to mitigate any concerns during the financial process.

As users navigate the withdrawal process, providing clear guidelines can significantly enhance satisfaction. Timely payouts and understanding compliance will reinforce trust in your platform, encouraging loyal participation.

Protecting identity is paramount throughout the entire workflow. Adopting robust encryption techniques and safeguarding personal information ensures a reliable environment.

For further insights on establishing secure transactions, check out https://winum.com.ar.

Best Practices for Identity Verification Processes

In the realm of user onboarding, adhering to regulatory requirements is paramount. Ensuring that individuals are who they claim to be not only builds trust but also protects sensitive information. Implementing robust user authentication methods is crucial in facilitating secure transactions and maintaining personal data security.

A streamlined sign-up process should integrate Know Your Customer (KYC) compliance measures. This involves collecting essential information while ensuring that users feel comfortable and secure throughout the experience. With clear communication regarding why personal details are needed, users are more likely to engage positively with the service.

Your platform should also address the withdrawal process meticulously. Verifying identities at this stage helps mitigate fraud risks and reinforces the integrity of transactions. Regular audits and updates to the verification process further enhance security, providing ongoing compliance with industry standards.

Prioritizing identity protection should never be overlooked. Utilize multi-factor authentication and encryption to safeguard user data. This not only complies with legal standards but also enhances user confidence as they navigate through your services.

Incorporating these best practices will ensure a secure environment, paving the way for an efficient operation that benefits both users and the platform.

Common Challenges in User Verification and Their Solutions

The sign-up process can often present hurdles for both users and operators, particularly in ensuring that personal data security is maintained. A frequent challenge is the complexity of user authentication procedures, which may deter potential participants. Simplifying this step can enhance user experience while upholding strong security measures.

Regulatory requirements can also pose difficulties. Operators must navigate varying compliance standards, such as KYC compliance, which can complicate the onboarding process. To address this, institutions may adopt automated solutions that streamline compliance checks while ensuring that users’ identities are thoroughly verified without lengthy delays.

Another concern arises during the withdrawal process. Users may face obstacles when trying to access funds, often due to inadequate verification of payment methods. Developing a clear guide for acceptable payment options and the steps required for identity protection can greatly alleviate frustrations.

Moreover, the handling of personal data security is critical. Protecting sensitive information from breaches should be a priority. Employing advanced encryption technologies and secure data storage protocols are effective solutions that contribute to stronger identity assurance while building user trust.

In conclusion, recognizing and addressing these challenges not only enhances the user experience but also contributes to a more secure environment. Implementing effective strategies leads to better overall outcomes for both users and operators in this dynamic sector.

Tools and Technologies for Effective Identity Management

In the realm of user onboarding, the tools employed for identity management play a pivotal role. Organizations are increasingly adopting advanced solutions to streamline user authentication, ensuring a seamless experience that meets regulatory requirements.

Implementing KYC compliance measures is paramount. These tools verify user details, mitigating risks and ensuring that only legitimate users gain access. This practice not only builds trust but also enhances the withdrawal process, allowing for expedited transactions.

Secure transactions are at the forefront of any identity management system. Using encryption and multi-factor authentication, individuals are protected against unauthorized access, reinforcing personal data security.

Technologies such as biometric recognition have made significant strides in recent years. Utilizing fingerprints or facial recognition, these systems enhance identity protection and reduce the likelihood of fraudulent activities.

As payment methods evolve, the integration of diverse options into the identity management framework becomes essential. By offering various payment solutions, businesses cater to a broader audience and simplify the transaction process for users.

- User Authentication: Streamlined processes ensure a hassle-free experience.

- KYC Compliance: Protects businesses from fraud through rigorous checks.

- Withdrawal Process: Facilitates quick and secure access to funds.

- Secure Transactions: Employs advanced encryption methods to safeguard user data.

- Personal Data Security: Prioritizes the confidentiality of user information.

- Regulatory Requirements: Adapts to the constantly evolving legal landscape.

- Payment Methods: Offers flexibility to meet user preferences.

As technology advances, maintaining a robust identity management system is crucial in building confidence and convenience for users while ensuring compliance and security in transactions.

Q&A:

What steps are involved in account registration?

Account registration typically involves several steps. First, you need to provide your personal information, such as your name, email address, and sometimes your phone number. After that, you’ll create a password that meets specific security requirements. Some platforms may require you to verify your email or phone number by sending a confirmation link or code. Once confirmed, your account can be set up fully, allowing you to access various features.

Why is identity verification necessary during account registration?

Identity verification is crucial during account registration to ensure the security of both the platform and its users. It helps prevent fraudulent activities, such as identity theft or unauthorized access. By verifying your identity, platforms can maintain trust and integrity within their user base. This process may involve submitting identification documents or answering security questions that only you should know.

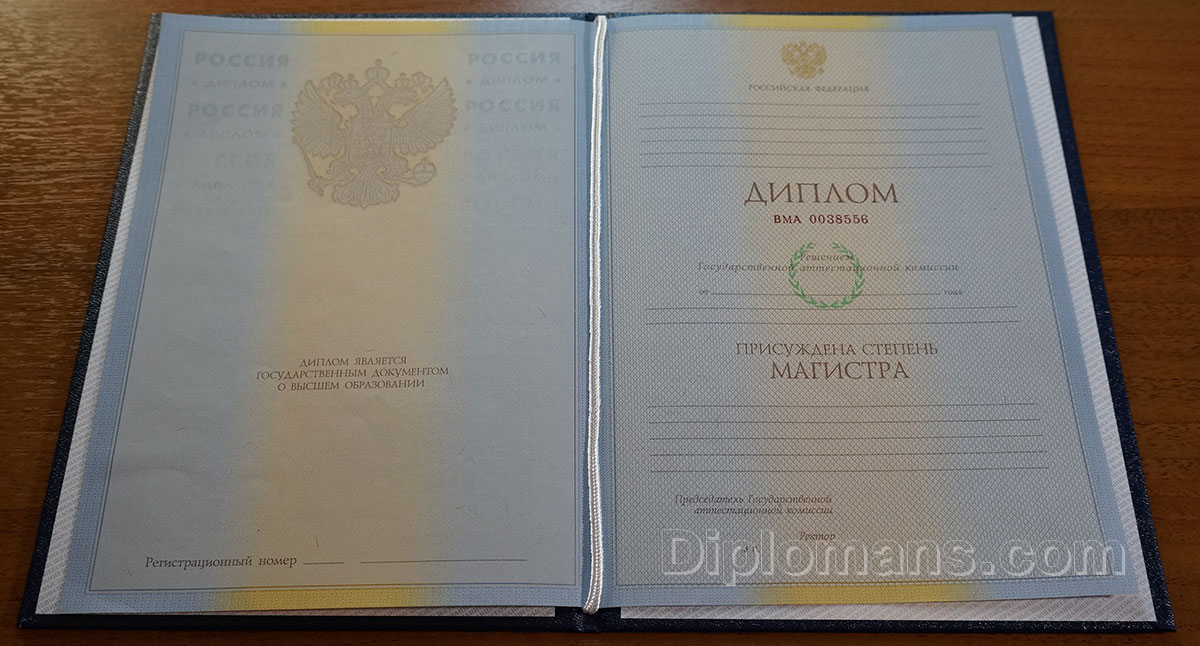

What documents are typically required for identity verification?

During the identity verification process, you may need to provide several types of documents. Commonly required documents include a government-issued ID, such as a passport or driver’s license, proof of address (like a utility bill), and sometimes social security information. Each platform may have its specifications, so it’s always good to check what is necessary before starting the process.

How does account registration differ between various online platforms?

Account registration can vary significantly across platforms depending on their requirements and security measures. For instance, financial services may have more stringent verification processes compared to social media sites. Some platforms might allow registration with just an email and password, while others may require extensive personal information and immediate identity verification. Understanding these differences can help streamline your experience when signing up for new services.